Designing Sustainable Tokenomics: A Practical Blueprint for Web3 Projects

- Author:Hashtrust Technologies

- Published On:Apr 18, 2025

- Category:Web3

In the world of crypto and Web3, tokenomics is one of the most important (and often misunderstood) elements of a successful token-based project. Good tokenomics can make or break your product, no matter how brilliant the tech is. So, how do you build it right from the start? This post provides a clear, no-nonsense framework to help founders, developers, and DAO creators structure tokenomics that are sustainable, community-driven, and growth-ready.

What Is Tokenomics, Really?

Tokenomics refers to the economic design of a token—how it’s created, distributed, used, and managed over time. It defines who gets how much, when, and why.

Done right, tokenomics:

- Aligns long-term incentives across users, contributors, and investors

- Creates real utility that supports your ecosystem

- Prevents pump-and-dump schemes and builds community trust

Let’s dive into the blueprint 👇

Tokenomics Blueprint: The Essentials

Token Overview

This defines your token's core identity—how exchanges, wallets, and smart contracts recognize it.

| Field | Description |

|---|---|

| Token Name | The full name of the token |

| Token Symbol | Short ticker/symbol for exchanges |

| Token Type | Blockchain standard used |

| Total Supply | The maximum number of tokens that will ever exist. Helps in understanding scarcity. |

| Decimals | How divisible is your token? Most ERC20 tokens use 18 decimals (like Ethereum). |

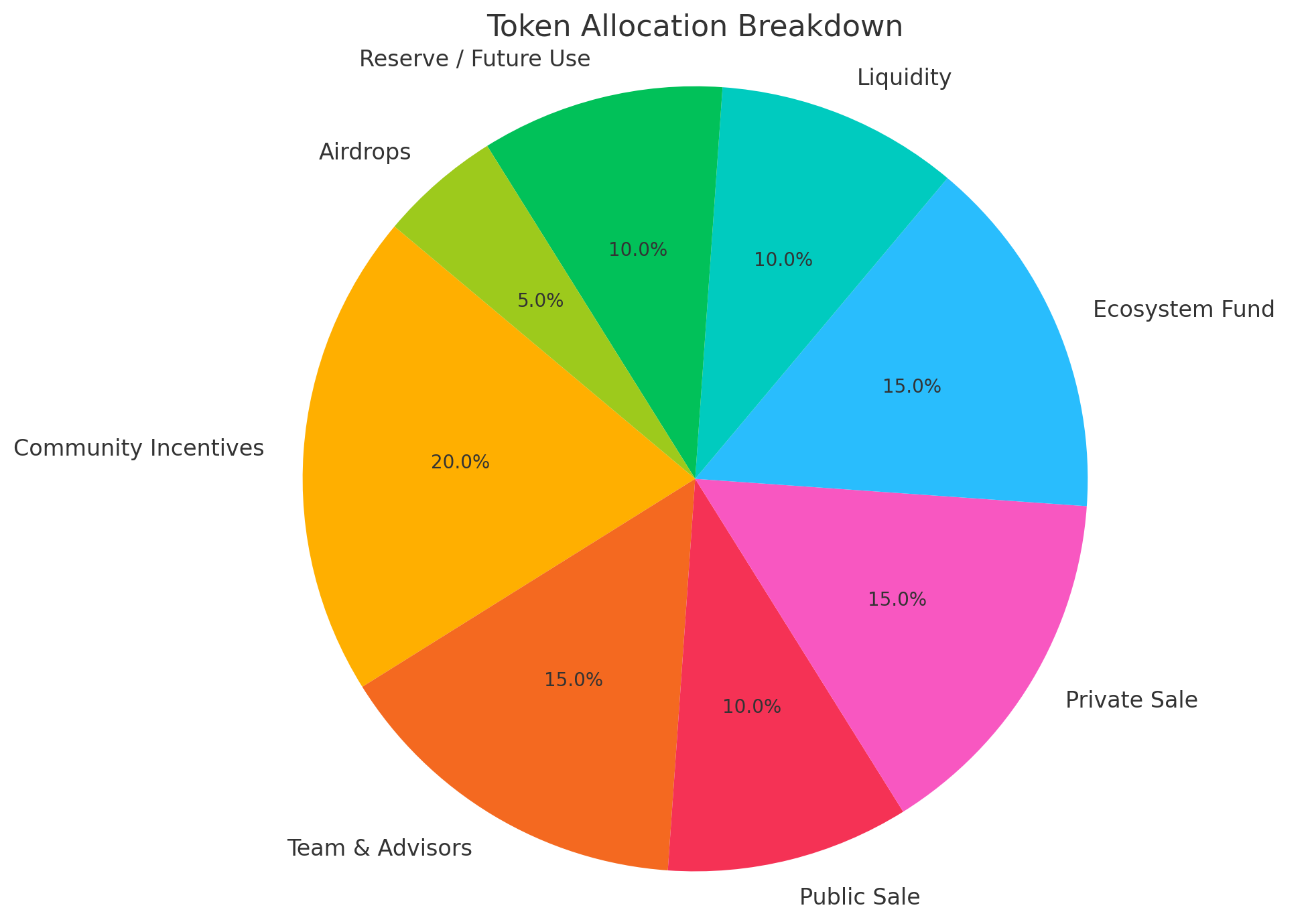

Token Allocation

This defines who gets how many tokens, why, and how those tokens are unlocked over time.

| Category | % of Supply | Amount | Vesting Details |

|---|---|---|---|

| Community Incentives | 20 | Released via quests, staking rewards, etc. | |

| Team & Advisors | 15 | 12-month cliff, vest over 3 years, monthly | |

| Public Sale | 10 | 50% on TGE, the rest over 6 months | |

| Private Sale | 15 | 20% on TGE, 3-month cliff, then linear | |

| Ecosystem Fund | 15 | DAO controlled or team for grants & rewards | |

| Liquidity | 10 | Used for initial DEX liquidity | |

| Reserve/Future Use | 10 | Locked, released if approved via vote | |

| Airdrops | 5 | Campaign-based drops to grow the user base |

Key Terms:

- TGE = Token Generation Event (launch date)

- Cliff = Time before any tokens unlock

- Linear vesting = A fixed number of tokens unlock per period

Why it matters: A balanced allocation ensures fairness, prevents rug pulls, and builds community trust.

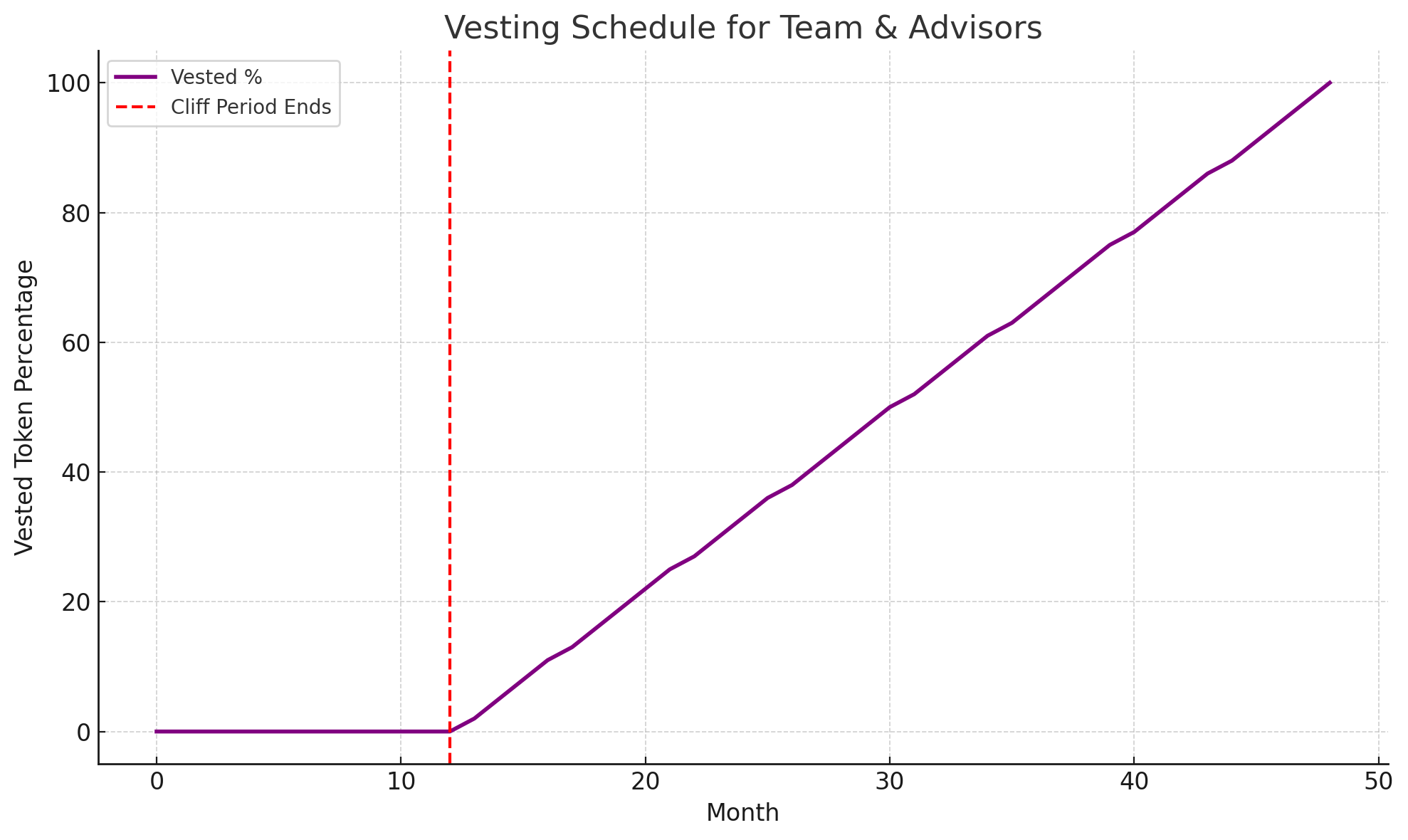

Vesting Plan

This prevents team/investors from dumping all tokens simultaneously and ensures long-term commitment.

Example (for Team):

- 12-month cliff (no tokens released)

- After 12 months, 1/36 of their allocation is released each month for the next 3 years.

- Fully vested by month 48.

Why: It protects the token price by avoiding sudden large supply unlocks.

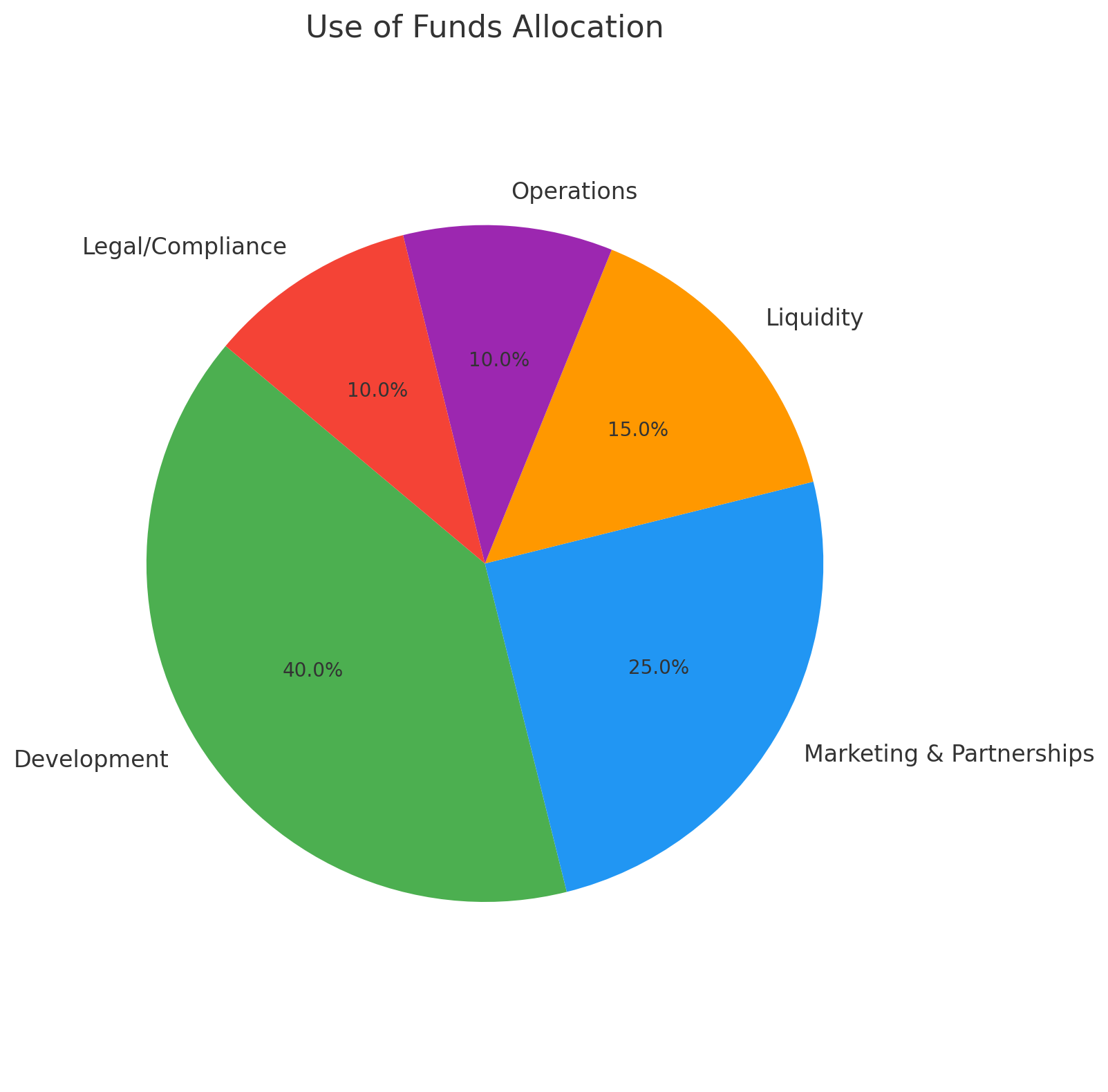

Fundraising Plan

This section shows how much money you want to raise by selling the token and how the funds will be used.

| Round | % Supply | Token Price in $ | Raise Goal | Unlock Model |

|---|---|---|---|---|

| Seed Round | 5% | $0.01 | $500K | 6-month cliff + 18M vesting |

| Private Sale | 10% | $0.02 | $2M | 3-month cliff + 12M vesting |

| Public Sale | 5% | $0.03 | $1.5M | 50% on TGE, the rest monthly |

Token Utility

This defines what the token is used for. A token with no use case has no value.

Common Utilities:

- Governance – Token holders vote on proposals (upgrades, spending funds, etc.)

- Staking – Lock tokens and earn rewards. This supports security or network operations.

- Payments – Used as a currency within your ecosystem or dApp (e.g., buy services, tip creators).

- Burning – A portion of tokens can be destroyed to reduce the total supply (adds scarcity).

- Access – Premium features or NFT minting may require holding tokens.

- Rewards – Earn tokens for referrals, bounties, bug reports, or being early users.

Solid tokenomics isn’t about hype—it's about creating a fair, sustainable, and rewarding ecosystem for everyone involved. If you're building a Web3 or AI-driven platform, this blueprint gives you a solid starting point. Adapt it. Stress test it. Let your community challenge it. And most importantly—deliver real value. Your token's core identity is how exchanges, wallets, and smart contracts recognize it.

Need Help Designing Your Tokenomics or Building Your Project?

At Hashtrust Technologies, we specialize in:

- Tokenomics consulting and modeling

- Blockchain protocol design

- AI agents + Web3 integrations

- End-to-end MVP and POC development

Whether you're launching a new DeFi protocol, building an agent-powered marketplace, or just exploring Web3, our team has helped dozens of founders turn bold ideas into scalable, production-ready products.

Further Reading: AI Meets Web3

As the Web3 landscape continues to evolve, the integration of AI into user analytics and engagement strategies is becoming increasingly valuable. For a broader perspective on how AI is transforming customer relationships and behavior tracking—key inputs for designing effective token economies—check out this expert roundup by GoodFirms: Know AI CRM, Know Your Customers

Reach out to us at support@hashtrust.in, Visit us at Hashtrust.in